Climate Change Renders Parts of America Uninsurable as Risk Increases

Insurance companies are facing increasing difficulties in providing coverage for damages caused by rising average temperatures, leading them to withdraw from certain markets. State Farm, accounting for a significant portion of the bundled home and commercial insurance policies in California, announced in May that it will no longer accept new applications for property and casualty insurance in the state due to surging construction costs, growing catastrophe exposure, and a challenging reinsurance market. Allstate, the fourth-largest property insurer in California, also made a similar decision last year, citing high costs for repairing homes, wildfire risks, and increased reinsurance premiums. Severe weather events, such as wildfires and heavy rainfall, have contributed to substantial insured losses in California in recent years. Climate change, along with population growth and inadequate land management practices, exacerbates these risks.

Other states, including Louisiana and Florida, have also seen insurers decline coverage due to mounting catastrophic losses. The withdrawal of insurance coverage can have significant economic consequences, influencing behavior among individuals, businesses, and policymakers. Insurance plays a crucial role in determining where people choose to live and whether they can rebuild after a disaster. The impacts of climate change on insurance availability and cost highlight the urgent need for systemic actions to mitigate risks, such as implementing better building codes and reducing greenhouse gas emissions. State Farm's recent decision underscores that climate change is not a distant threat but an immediate concern with tangible effects on people's lives and the financial sector.

Some have suggested that covering the Sahara Desert with solar panels could harness its abundant sunlight and provide a vast, sustainable energy source.

After a challenging six months marked by the driest October in 73 years, the Panama Canal is finally seeing a turnaround.

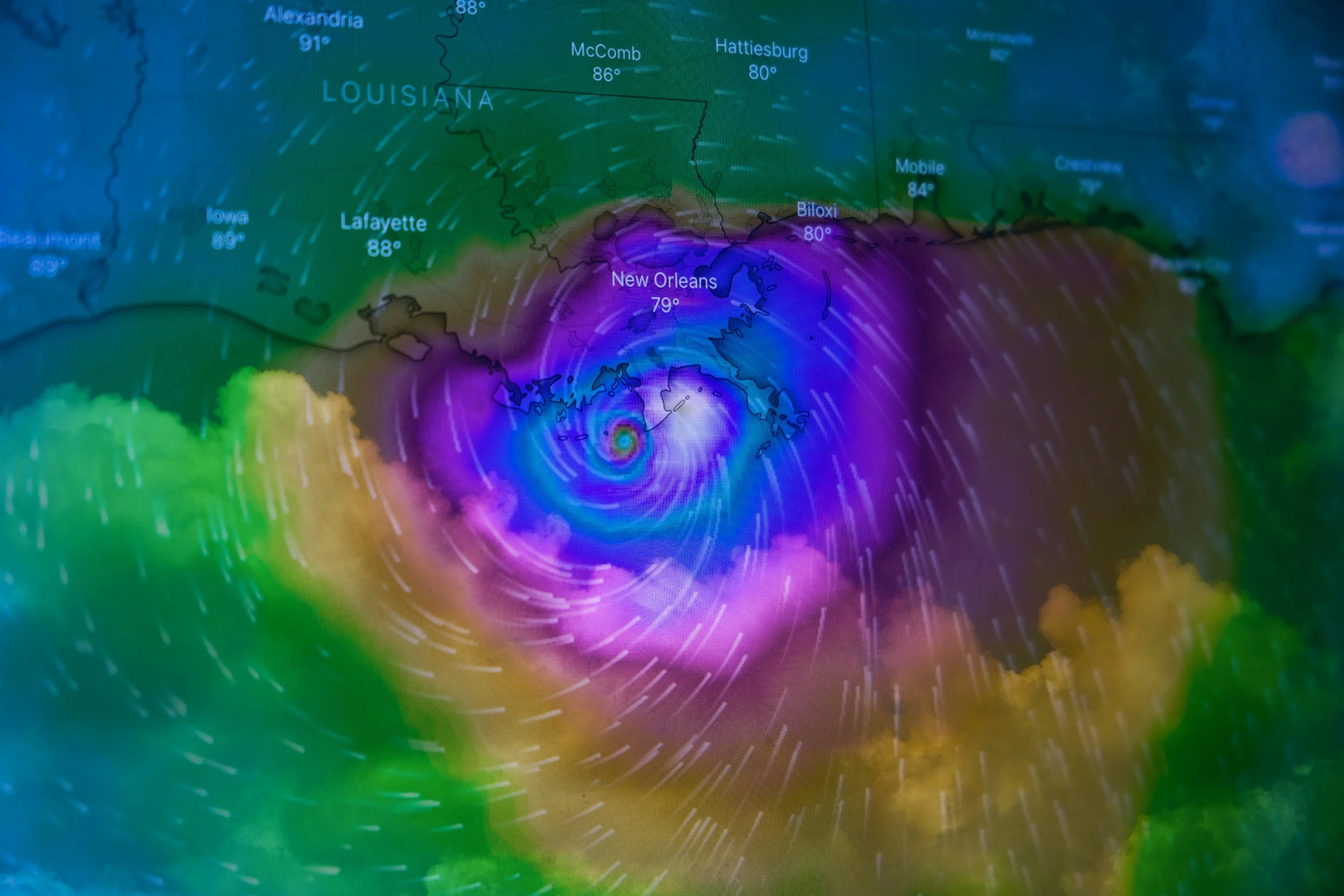

It looks like New Orleans and its surrounding areas might be in for a pretty intense hurricane season.

Public transport services in Germany came to a halt as strikes organized by the Verdi union over working hours swept across 14 states, including Berlin.

Climate change is causing a major headache for global trade as an unprecedented drought in the Panama Canal disrupts container traffic.

2023 is likely to become the hottest year on record, with a more than 99% chance of surpassing the previous record holder, 2016, according to climate scientists.

The Lahaina Fire on Maui, responsible for the deadliest wildfire in American history, was fueled by a downslope windstorm, debunking earlier links to nearby Hurricane Dora.

The recent U.N. agreement among nearly 200 countries to transition away from fossil fuels is being celebrated as a significant step in addressing climate change.

COP28 in Dubai marked a historic moment as nations committed to transitioning away from fossil fuels to combat climate change.

Greta Thunberg, the prominent climate activist, criticized the COP 28 climate deal reached in Dubai, stating that it is insufficient to prevent temperatures from rising above 1.5 degrees Celsius, which is considered a critical limit by scientists.

Over 160 industry groups, think tanks, and PR agencies with a history of climate denial have scored access to the UN climate talks in Dubai.

The latest draft of the COP28 climate agreement has removed the call to phase out fossil fuels, replacing it with a broader call for countries to reduce planet-warming pollution.

The decade from 2011 to 2020 was the hottest ever recorded for both land and oceans, with a significant increase in climate change, according to a report by the World Meteorological Organization (WMO) released at COP28 in Dubai.

Tesla, GM, and other companies will use the Climate TRACE database from Al Gore's climate coalition, utilizing satellites and machine learning to monitor global greenhouse gas emissions.

Multiple storms are expected to hit the Northwest in the coming days due to atmospheric rivers, bringing heavy rain and significant snowfall.

The United Nations has declared that 2023 is on track to be the warmest year on record, with global temperatures rising 1.4 degrees Celsius above pre-industrial levels

The United Arab Emirates (UAE) has denounced what it calls "fake news" aimed at undermining its role as the host of the COP28 climate conference, including false reports about the resignation of COP28 president-designate Sultan Al-Jaber from his position at the state oil giant ADNOC.

Photographer James Balog and his team, originally skeptical about climate change, witnessed an extraordinary event while filming in Greenland.

Eight years after the Paris Agreement, the oil industry is thriving, with rising profits and record production levels, especially in the United States.

The United States and China, the world's top two carbon emitters, have agreed to collaborate on addressing global warming by significantly increasing their investment in renewable energy sources such as wind and solar power to reduce their reliance on fossil fuels.

A recent federal report, the Fifth National Climate Assessment, warns that the impacts of rapid climate warming are being experienced across the United States and will worsen in the next decade if fossil fuel use continues.

A United Nations-backed report reveals that major fossil fuel-producing countries, including the United States, Russia, and Saudi Arabia, are on course to produce twice the amount of fossil fuels that exceed critical global warming thresholds by the end of this decade.

2023 is almost certain to become the hottest year on record due to an extraordinary run of global temperature records, according to the EU's Copernicus Climate Change Service (C3S).

The Michigan House has approved a set of reforms to combat climate change, which includes a requirement for utilities to rely entirely on clean energy sources by 2040.

A United Nations report highlights that humanity is approaching multiple critical "tipping points" that could result in irreversible ecological and institutional system disruptions.

California Governor Gavin Newsom discussed the need for specificity in addressing chemical issues with President Xi Jinping during his visit to China.

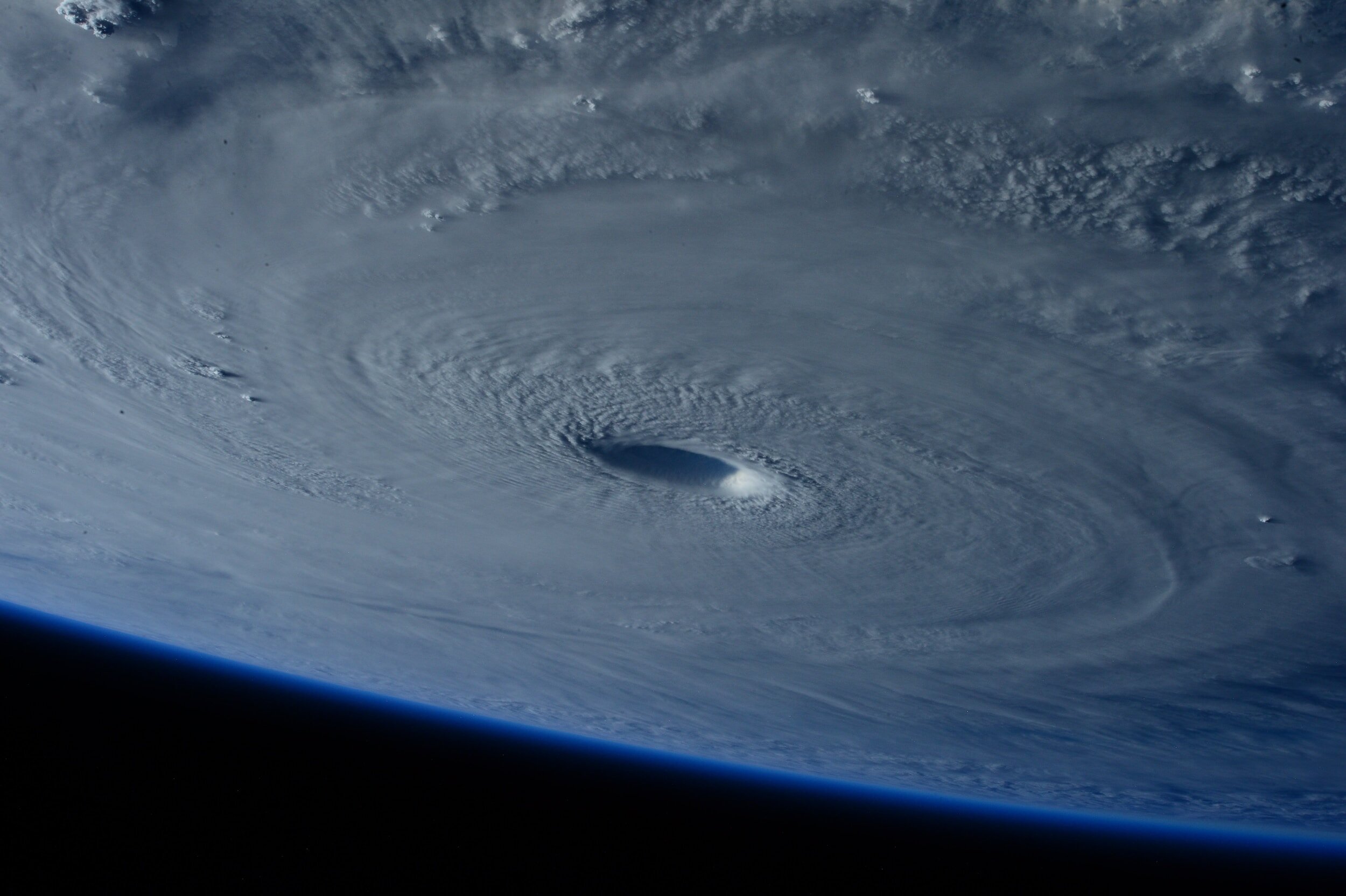

Hurricane Otis underwent an astonishing transformation from a minor threat to a catastrophic monster within a single day.

California Governor Gavin Newsom embarked on a week-long trip to China, emphasizing his state's commitment to climate issues regardless of the U.S. presidential election outcome.

Several factors contribute to the current record-breaking global temperatures.

Get ready for some serious heat!