Supply chain technology deals are facing obstacles due to teetering Silicon Valley

According to a report by PitchBook, venture capital (VC) investment in the supply chain technology sector experienced a significant decline in Q1 2023, plummeting by 45.3% compared to Q4 2022. The report suggests that the collapse of Silicon Valley Bank in March likely contributed to this sharp downturn in VC deals. The collapse of the tech lender triggered a major financial crisis that had a ripple effect on VC investment across various sectors, including supply chain technology. However, the report does highlight some positive developments, such as the increased deal value in the freight tech sector, with Sweden being involved in two of the largest deals in that area.

PitchBook's report reveals that the overall value of supply chain tech deals in 2022 returned to levels similar to the average figure observed between 2018 and 2020, prior to the significant increase in deals and VC funding driven by the pandemic in 2021. In terms of specific vertical supply chain tech markets, enterprise supply chain management, last-mile delivery, and warehousing tech saw modest increases in value. The report also highlights a notable VC deal in Q4 2022, where Locus Robotics secured $117 million, nearly doubling its valuation. Locus Robotics specializes in autonomous mobile robots for warehouse operations, offering advantages over traditional materials-handling solutions in terms of flexibility and rapid deployment. The company's robotics-as-a-service business model provides operational flexibility and allows for easy redeployment to other facilities.

Imagine zipping from New York to Los Angeles in less than an hour or hopping from London to Paris in just 15 minutes.

U.S. Commerce Secretary Gina Raimondo stated in an interview that more controls on tech exports to China will be implemented as needed, despite concerns from businesses.

A group of German hackers recently breached a Tesla car, not with malicious intent but to access a paid feature – heated rear seats.

The North Central Texas Council of Governments (NCTCOG) is implementing a five-year intelligent traffic signal optimization program in the Dallas-Fort Worth area to reduce the number of stops for trucks at traffic lights.

Iran's APT34, also known as OilRig, has launched a supply chain attack targeting government entities in the United Arab Emirates (UAE).

The logistics industry is undergoing significant transformations in the digital age.

Ryder System, a leading logistics and transportation giant based in Miami, has established an innovation laboratory in Silicon Valley with a focus on transforming transportation and supply chain networks and preparing for the upcoming wave of AI technologies.

Nikola Corporation and J.B. Hunt Transport Services Inc. have reached an agreement for J.B. Hunt Transport Inc., a subsidiary of J.B. Hunt, to purchase 13 zero-emission Class 8 trucks from Nikola.

US Commerce Secretary Gina Raimondo is planning to visit China in late August as part of the Biden administration's efforts to ease tensions between the two largest economies in the world.

Kodiak Robotics is leading the pilot of the Commercial Vehicle Safety Alliance's new protocol for autonomous trucks called the Enhanced Commercial Motor Vehicle Inspection Standard program.

Several major tech companies, including Amazon, Google, Meta, Microsoft, and others, have made voluntary commitments to meet a set of artificial intelligence (AI) safeguards brokered by the White House.

The long-awaited era of flying cars may become a reality by 2025 as Tavistock Development Company plans to launch its first flying car service in central Florida.

The concept of Universal Identification Devices (UID) for trucks, proposed by the Federal Motor Carrier Safety Administration (FMCSA) in response to a petition from the Commercial Vehicle Safety Alliance (CVSA), raises numerous questions.

CADDi, a global procurement startup, has secured $89 million in a Series C funding round, even as the supply chain management sector has experienced a decline in funding.

The logistics industry has experienced significant changes due to advancements in technology.

Following the MOVEit ransomware cyberattack, a cybersecurity expert highlights the significant threat posed by supply chain cyberattacks, which have the potential to force organizations out of business.

Detroit-based non-profit Henry Ford Health has successfully reduced its supply expenses, despite ongoing inflation concerns for hospitals.

The Port of Nagoya, Japan's largest maritime port, fell victim to a ransomware attack allegedly carried out by a Russian cybercriminal group, causing significant disruptions to cargo operations.

Saudi Arabia has achieved a significant milestone in its pursuit of commercial electric vertical take-off and landing (eVTOL) operations with the successful completion of the first test flight of a flying taxi.

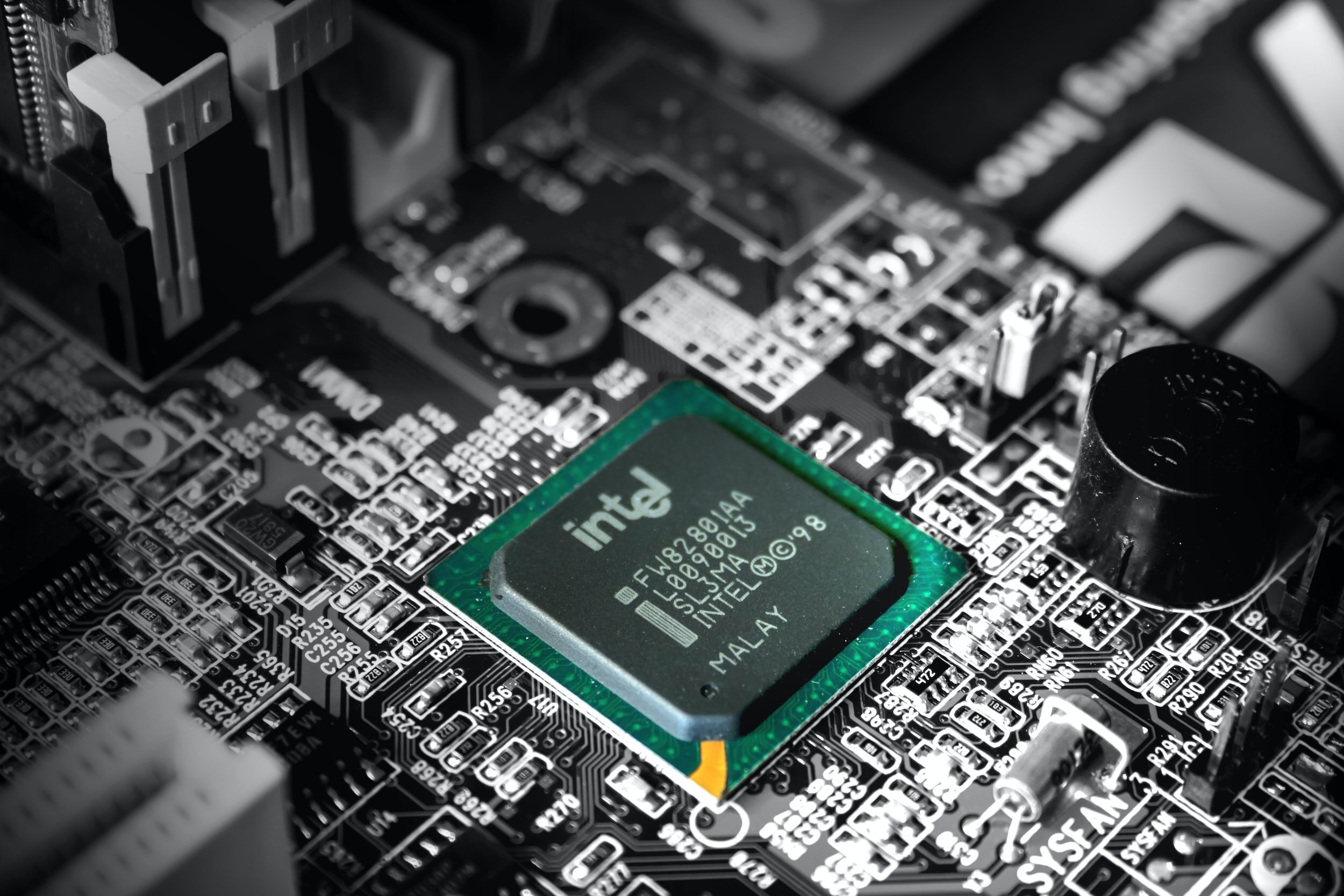

Intel is investing $4.6 billion in a new assembly and testing facility in Poland and expanding its investment in a semiconductor fabrication plant in Germany, totaling approximately $33 billion.

A massive search effort is currently underway in the remote North Atlantic to locate the missing Titan submersible, which carried five individuals.

The disruptions and rising freight costs experienced in recent times have prompted businesses to seek aggressive cost-saving measures.

Supply chain control towers are increasingly recognized as crucial tools in addressing the challenges faced by organizations, particularly in terms of visibility and decision-making.

Technology plays a vital role in the supply chain, empowering and improving processes in the movement and storage of goods.

Digitalization has brought about transformative changes in logistics and the supply chain, revolutionizing global operations.

The recent crash of the crypto market hasn't dampened the potential of blockchain technology, which continues to hold promise as a solution to various problems.

Beyond technology and processes, there is ample room for innovation in supply chain management and logistics through business model transformation.

Transportation management systems (TMS) have become crucial investments for shippers, but selecting the right one can be challenging.

The concept of the Internet of Things (IoT) has evolved significantly since its inception, moving beyond tracking larger items to encompassing smaller units as well.

The US Justice Department and multiple states are suing Apple, accusing it of monopolizing the smartphone market.