Supply Chains on the Path to Recovery: An Overview

In the wake of recent challenges, the resilience of global supply chains has been put to the test. However, there are encouraging signs that point to a recovery underway. While some hurdles remain, particularly in electronics and durable goods manufacturing, there are positive developments worth exploring.

Let's take a closer look at the data and trends that shed light on the path to recovery.

Supply chains are recovering

The next few charts come from an article published this week that makes a strong case for supply chain renewal. It argues that while some problems persist, the supply chain crisis, especially in key sectors like semiconductors and automobiles, is over.

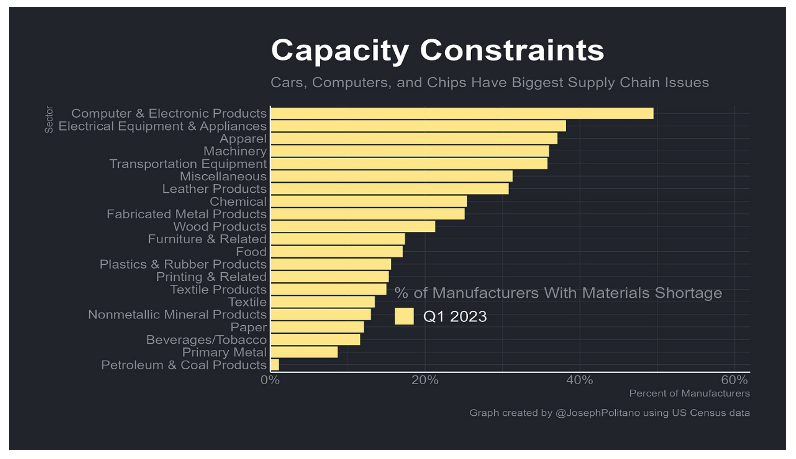

First, the pandemic-induced spikes in material shortages and logistic constraints are decreasing. According to U.S. Census data, the percentage of manufacturing firms citing shortages and constraints as reasons for operating below capacity has significantly dropped.

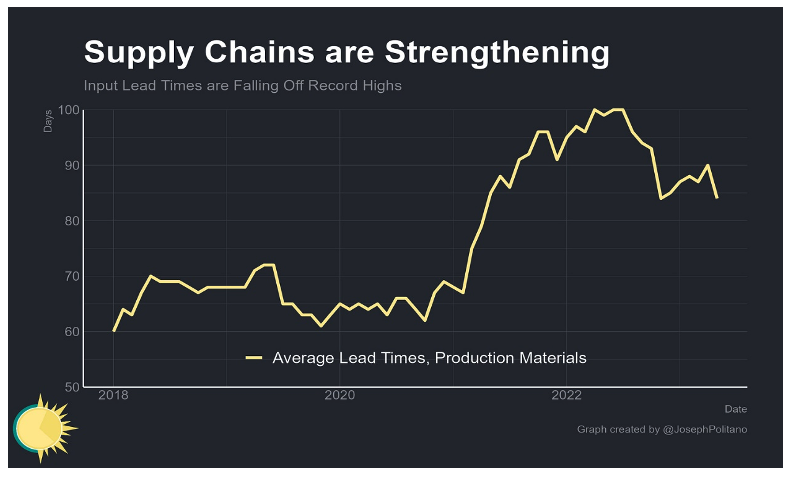

In addition, lead times for production materials have shortened – the time between order and delivery has dropped notably since highs in late 2021.

However, not every sector has fully recovered. Supply constraints are disproportionately concentrated among electronics and durable goods manufacturers. For instance, approximately 50% of computer/electronics manufacturers cite material shortages as a constraint on output, while electrical equipment and transportation equipment (cars and trucks) manufacturers remain above 35%.

The percentage of car and electronics manufacturers citing material shortages has significantly dropped. The worst of the semiconductor shortage seems to be over. However, it is worth noting that, by historical standards, the percentage of firms citing shortages remains elevated.

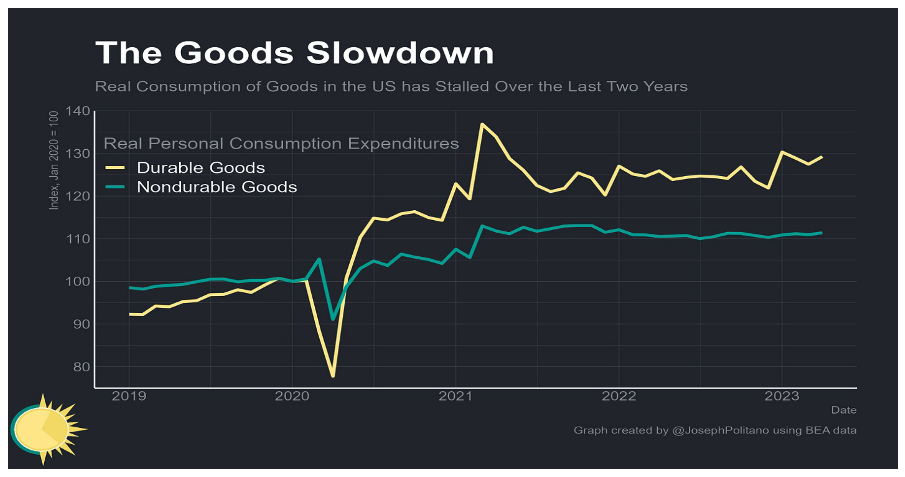

Strong consumer demand for durable goods has finally subsided as well. In early 2021, durable goods consumption surged 20% above pre-pandemic levels, driven by increased savings, reduced spending on services, and well-timed government stimulus packages. However, goods spending has now slowed down, and the Fed's rate increases indicate that durable goods consumption will likely remain stagnant or even decline further.

Finally, in the aftermath of the pandemic, the Biden administration passed the CHIPS Act and Inflation Reduction Act. Both laws made substantial investments in domestic manufacturing to boost capacity and establish more robust and resilient supply chains.

The last chart indicates that the construction progress is continuing at an unprecedented rate. Domestic construction spending reached $190 billion last month, with over 50% of the investment directed towards computer and electronic manufacturing facilities, including semiconductor production.